Credit Card Surcharges: A Deep-Dive Into Surcharging, Customer Sentiment & What Other Businesses Are Doing

Running a business, particularly in the hospitality industry, is becoming increasingly expensive. With skyrocketing operating costs, high employee wages and ever-increasing inventory prices, hospitality venues are battling tight margins and shrinking profitability.

Unsurprisingly, many businesses are looking for ways to cut costs and ease the financial pressures that have arisen due to inflation.

One cost that almost all hospitality businesses incur is merchant service fees from their payment provider. And according to a recent survey, 60% of Australian businesses are concerned about the cost of their merchant service fees.

While these fees are a pressing concern for many businesses, there’s often reluctance within the industry to pass these costs on to customers through a credit card surcharge. Many business owners are worried this will negatively affect customer satisfaction and loyalty.

With this in mind, we take a closer look at credit card surcharges, their pros and cons, customer sentiment around surcharging and what other businesses are doing.

Let’s dive in.

- What are credit card surcharges?

- What does the law say?

- The pros and cons of credit card surcharges

- Customer sentiment towards credit card surcharges

- What are other businesses doing?

- Surgarging: What are your options?

What are credit card surcharges?

A credit card surcharge is an additional fee that some businesses charge their customers when they pay with a credit or debit card via an EFTPOS machine.

Every customer credit or debit card transaction costs your business money, as each purchase made by your customers via an EFTPOS terminal incur different fees from your bank/payment processors.

To help cover these costs, many businesses opt to pass these expenses onto their customers with a credit card surcharge.

Merchant fees

Merchant fees are the fees charged by a payment provider, such as Visa, for processing card transactions. This is usually a percentage of the transaction amount; however, prices vary, and credit cards often incur higher merchant fees than debit cards.

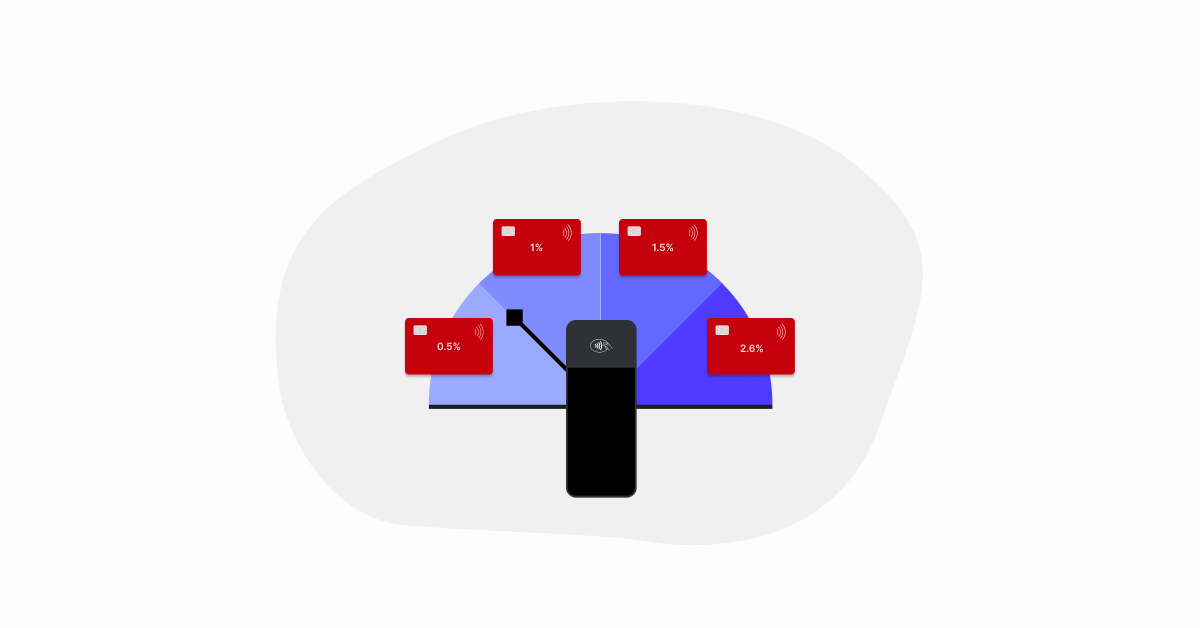

On average, the most popular card types in Australia charge the following merchant fees:

- Visa and Mastercard – 1.5%

- Visa debit – 1.5%

- American Express – 2.6%

Payment processing fees

To accept credit cards, debit cards and digital payments, like Apple Pay, you’ll need to partner with a payment processor, like Lightspeed Payments, also known as an acquirer, to facilitate these payments.

Your chosen payment processor will provide you with hardware, such as an EFTPOS terminal, that enables you to accept and process both card and digital payments. Payment processors clear transactions, then route and deposit the money in your bank account. They essentially act as the middleman between your venue, your customers, the merchant card network (e.g. Visa or Mastercard) and the issuing bank.

In exchange for these services, payment processors charge a fee, usually up to 2% of the transaction value.

What does the law say?

Credit card surcharges are legal; however, the ACCC has laid out clear guidelines for businesses to follow. If a company fails to comply with the rules, it can face a hefty fine, and in some cases, business owners can face community service and probation orders.

How to remain compliant

Payment surcharge rules in Australia only allow businesses to recoup the costs of accepting certain payment methods. While the ACCC doesn’t specify an amount or percentage, they make it clear that any charge should not be excessive and only cover the cost incurred by the business.

The most common cost that a credit card surcharge can cover is the merchant/payment processing fee. However, there are several other costs associated with card transactions that can also be covered by a surcharge, such as fraud prevention services and gateway fees.

Excessive surcharges

The ACCC explicitly bans excessive surcharges. A surcharge is deemed excessive if your business recoups more from the customer than you pay to facilitate the transaction.

Let’s say a business charges a flat fee of 50c as a surcharge for card payments under $10. If a customer purchases a drink for $4 with their debit card, the 50c fee equals a 12.5% surcharge. If their payment processing fees are only 1%, then the 50c surcharge would be deemed excessive, as it costs the business much less to accept the transaction.

The pros and cons of credit card surcharges

While every business is different and will have differing views on the pros and cons of credit card surcharges, there are two main points to consider.

The main benefit of charging a credit card surcharge is obvious – it saves your business money.

According to Statista, the number of EFTPOS terminals in Australia has grown by a whopping 269% since 1998, emphasising how consumers have increasingly favoured cards over cash payments.

With the majority of customers opting to pay with a card, a credit card surcharge can save you tens of thousands of dollars each year that can be reinvested elsewhere in your business.

On the other hand, many businesses fear that charging a credit card surcharge is risky, as it has the potential to negatively impact customer satisfaction and loyalty.

However, these fears may be unfounded. A recent study found that only 21% of customers who have paid a credit card surcharge said their satisfaction with the business fell. This means nearly 80% of customers aren’t too phased by businesses adding on a credit card surcharge.

![]()

Customer sentiment towards credit card surcharges

It’s widely assumed that credit card surcharges aren’t always a hit with customers; as a result, businesses often opt to forego charging this fee and absorb the extra costs or factor it into their pricing instead.

While some older studies point towards consumers resenting surcharges, more recent data show that customers are slowly becoming more understanding of the financial constraints facing hospitality businesses, so they are more willing to pay a surcharge.

In 2020, a study by Amex found that 78% of customers thought surcharging was unfair. However, as credit card surcharges become more commonplace, consumers are beginning to understand the “why” behind surcharging better – and are slowly starting to see it as fair.

Fast forward two years, and a 2022 study found that 85% of customers pay credit card surcharges without issue or complaint – highlighting a shift in customer sentiment.

Education is key

The more aware customers are of the financial constraints facing their favourite hospitality businesses, the more willing they’ll become to pay a surcharge. Therefore, customer education and increasing awareness of why your business opts for a credit card surcharge is key.

After all, opting to pay by card is convenient for customers, and payment providers offer a service that allows consumers to make card payments – a service that doesn’t come for free but is often paid for by businesses rather than customers.

What are other businesses doing?

Traditionally, many hospitality venues have steered away from charging a credit card surcharge to not upset customers. However, with increased operating costs and a shift in customer sentiment towards surcharging, many businesses now opt for a surcharge.

Recent research, taken from over 66,000 Australian businesses, found that as of May 2023:

- 40% of cafes and restaurants levied surcharges, up from 25% in May 2022

- 41% of pubs and bars opted for a surcharge, up from 29% in 2022

- 26% of fast food restaurants charged a surcharge, up from 16% in May 2022

Lightspeed customer Wheelchair Sports NSW/ACT recently followed the growing trend of venues charging customers a surcharge, so they opted for Lightspeed Payments to easily pass their merchant fees on to their customers.

“We did the change to Lightspeed Payments recently to be able to pass on the surcharging to the customers, which is really important for us,” commented David Krantz, General Manager of Kevin Betts Stadium.

“That was a few hundred dollars a month that we were paying to (the bank), so that was a huge reason why we opted for that change.”

Surcharging: What are your options?

If you’re planning to implement a credit card surcharge in your venue, there are two main ways to do this – either a flat fee or a percentage charge.

1. Flat fee

We touched on charging a flat fee earlier, and while it is legal to charge a flat fee as a surcharge, businesses should be cautious when doing so, as small transaction values with a flat fee surcharge are likely to be excessive.

If your bank charges a flat fee per transaction rather than a percentage, then passing that fee onto the customer is acceptable.

2. Percentage charge

The most common practice for a credit card surcharge is charging a percentage that reflects the payment processing fee percentage charged by your payment processor.

For example, with Lightspeed Payments you can automatically pass on your payment processing fees to your customers with the automatic surcharging feature.

Minimum transaction value for card payments

If you’re wary of charging a surcharge for card payments in your venue, another option is to set a minimum transaction value for EFTPOS payments. Businesses aren’t required to offer card payments as a payment option, so business owners are free to decide what transaction value is reasonable for an EFTPOS payment.

For example, you’ll often see small businesses only accepting card payments over $10. It’s also common for businesses to charge a flat fee, say 50c, if the minimum $10 transaction value hasn’t been met. In this scenario, business owners should be extremely cautious as this fee would be considered a surcharge and deemed excessive, violating the payment surcharge regulations.

To charge or not to charge?

With cash payments on the decline and merchant fees to process, card payments are a growing expense for hospitality businesses. As a result, an increasing number of businesses opt for a credit card surcharge to cover these costs, which can often be set up through your POS system.

For example, when it comes to merchant service fees, Lightspeed Payments has an automatic surcharging feature that allows you to pass on any card processing fees to customers – essentially making your transaction fees 0%.

There’s no right or wrong answer when it comes to charging a credit card surcharge, and the decision is really up to you and how you think it’ll benefit your business. However, before rolling out a credit card surcharge, it’s essential to weigh the pros and cons and consider how it will impact your customers and your bottom line.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.