Australia is rapidly heading towards a cashless society, with recent data from the Reserve Bank of Australia (RBA) suggesting that 76% of payments are made by credit or debit card. The data also shows that cash makes up just 13% of payments, while 11% of transactions are paid using other methods such as cheque, BPAY or PayPal.

While credit and debit cards offer ultimate convenience for customers, accepting credit cards can be costly for businesses. From interchange fees to assessment fees and payment processor charges, there are several credit card fees that businesses have to pay for accepting customer card payments.

With so many different components, it can be tricky to differentiate between the various fees and understand who is charging them and why they’re being charged.

In this article, we aim to cut through the noise and break down the different types of credit card fees, what the fees cover and if it’s possible to avoid paying them.

Let’s dive in.

- What are credit card fees?

- How are credit card fees decided?

- Understanding the different types of credit card fees

- A closer look at payment processor fees

- What else can impact your credit card processing fees?

- Can you avoid paying credit card fees?

What are credit card fees?

Credit card fees are the fees a business needs to pay for accepting credit card payments.

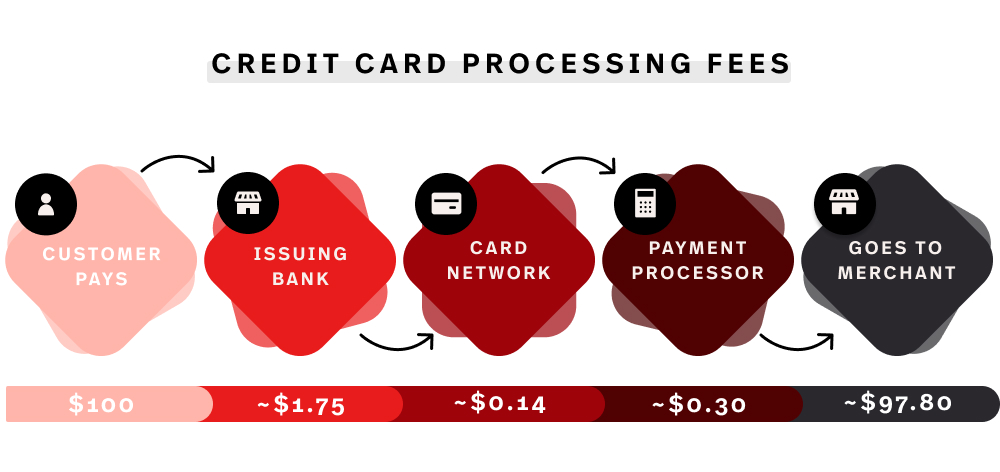

To facilitate credit card transactions, several key players work behind the scenes to ensure your customers can pay with their credit cards and that you receive the funds in your bank account.

In return for these services, each player charges a small fee, usually a percentage of the total transaction.

There are usually three main parties involved in processing credit card payments, these include:

- Card issuing bank, e.g. ANZ and Commbank

- Card networks, e.g. Visa and Mastercard

- Your payment processor, e.g. Lightspeed

Essentially, every customer credit or debit card transaction costs your business money. Each card purchase made via an EFTPOS terminal incurs a different fee from each of the above parties to ensure the transaction can occur.

How are credit card fees decided?

Credit card fees are determined through a complex system involving multiple parties in the payment processing ecosystem. These fees can vary based on several factors, including the type of business, the method of accepting payments, the card networks involved, and the payment processing provider.

For restaurants, credit card fees are typically decided by three parties involved in processing your customers’ credit card transactions. As mentioned earlier, these are card issuers, card networks and payment processors.

Card issuers

Card issuers, such as ANZ and Commbank, charge interchange fees to cover the costs of processing the transaction between your customers and your business. This fee can vary greatly depending on the type of card being used by your customers. However, it is usually a small percentage of the total transaction amount.

Card networks

Each card network, such as Visa, Mastercard and American Express, charges assessment fees for the ability to process transactions through their payment network.

Payment processor

Payment processors clear transactions, then route and deposit the money in your bank account. Essentially, they act as the middleman between your venue, customers, card network and issuing bank.

In exchange for these services, payment processors charge a fee, usually a flat fee or a percentage of the transaction value.

The diagram is for illustrative purposes only.

What else can impact your credit card processing fees?

Aside from card issuers, card networks and payment processors, several other factors can impact credit card processing fees.

Merchant Category Code (MCC)

Businesses are assigned a four-digit MCC that categorises their industry, for example, restaurants, bakeries or bars.

Different MCCs can have different interchange rates, meaning fees may vary depending on the type of business. While this is unlikely to impact businesses within the hospitality industry, high-risk industries, such as online gambling or adult entertainment, may face higher interchange fees.

Transaction Type

Credit card processing fees can differ based on the transaction type. For example, card-present (in-person) transactions typically have lower fees than card-not-present (online or over-the-phone) transactions due to lower fraud risk.

Card-present (CP) transactions are most common for hospitality businesses and include face-to-face transactions where the physical card is swiped or inserted into a card reader. CP transactions tend to have lower fees due to lower fraud risk.

Card-Not-Present (CNP) includes transactions where the card is not physically present, such as online or phone orders. CNP transactions may have higher fees because of the increased risk of fraud.

Card Type

Credit card issuers offer various types of cards, such as rewards cards or corporate cards, each with its own interchange rate. Businesses may face higher fees when processing premium or corporate cards because these cards often have higher interchange rates.

Understanding the different types of credit card fees

Earlier, we outlined the three key parties involved in determining your credit card fees; now it’s time to explore what these fees encompass and why they’re charged.

Interchange fees

Card issuers, usually a bank or credit union, charge interchange fees. Every time a customer pays with a credit or debit card, the acquiring bank (e.g. your business account) has to pay an interchange fee to the card-issuing bank (e.g. your customer’s account).

On average, credit card interchange fees range from 1.5% to 3.3%; however, they are often subject to regular change.

Interchange fees help card-issuing banks cover the costs associated with processing payments, such as fraud risks and handling costs.

Assessment fees

Card networks such as Mastercard charge Assessment fees, also known as dues and assessments, to use their card brands and process transactions through their payment networks.

There are two main differences between interchange fees and assessment fees.

Firstly, assessment fees are charged on a monthly basis, based on the total monthly sales volume, and not on individual transactions as with interchange fees.

Secondly, assessment fees are usually lower than interchange fees. The major networks’ average credit card assessment fees fall around 0.14%

However, the amount you pay in assessment fees can vary, depending on the card network, if a credit or debit card is used and transaction volume.

Payment processor fees

Finally, payment processor fees are charged by your payment processor for using their products – namely, the payment hardware and software that allows you to accept card payments.

Payment processors offer various pricing models, including flat-rate, tiered, and interchange-plus pricing. Fees can be charged as a percentage of the transaction, as monthly fees and, in some cases, through hidden fees.

Lightspeed, for example, charges a small flat rate of 1.5% per card-present (CP) transaction amount with no monthly or hidden fees.

A closer look at payment processor fees

There’s a common misconception that one hundred per cent of the payment processor’s markup goes towards their bottom line. While that might be true for some companies, it doesn’t ring true for all payment processors.

Reinvesting processor fees

Some payment processors, like Lightspeed, have an all-in-one solution where payments are embedded directly into the point of sale (POS) system. This means that revenue generated from payment processor fees can be reinvested back into the product, ensuring capabilities and features constantly evolve to meet business needs.

Lightspeed, for example, constantly invests in service capabilities and product enhancements to provide businesses with the best possible tech to run and grow their business. These include (but aren’t limited to):

- Fraud prevention and security help keep your business PCI compliant. All businesses that accept credit cards must meet PCI security standards. Lightspeed Payments allows your business to comply and securely accept, store, process, and transmit cardholder data during debit and credit card transactions.

- Unified POS platform that’s constantly evolving and designed to make your job easier so you don’t invest more time or money than necessary to make your business work.

- 24/7 support teams are available round the clock to help your business whenever you need it.

- Advanced insights with in-depth, real-time data allow you to track sales and other essential business metrics so you can make important, cost-saving decisions that increase your margins.

Can you avoid paying credit card fees?

Credit card fees are an inevitable part of doing business, and if you accept card payments, it’s impossible to avoid paying them altogether. However, there are a couple of ways to minimise the fees you pay.

Negotiate your pricing

Some businesses, particularly larger or high-volume merchants, have the opportunity to negotiate credit card processing fees with their payment processors, which can lead to customised pricing based on your business’s specific needs and volume.

Lightspeed, for example, offers a customised rate for high-volume businesses.

It’s also essential for businesses to carefully review and understand the terms of their agreements with their payment processor and be aware of all potential fees. It may also be beneficial to periodically review your processing agreements and negotiate prices when possible to minimise your credit card processing costs.

Credit card surcharges

Aside from negotiating your pricing with your payment processor, it’s also possible to pass on your credit card processing fees to your customers through a credit card surcharge.

The most common practice for a credit card surcharge is charging a percentage that reflects the payment processing fee percentage charged by your payment processor.

For example, with Lightspeed Payments, you can automatically pass on your payment processing fees to your customers with the automatic surcharging feature.

A recent survey found that 60% of Australian businesses are concerned about the cost of their credit card processing fees. While credit card fees are unavoidable for most businesses, we hope this article has explained why processing fees are charged, where the prices go and how you can reduce the cost of your credit card processing fees.

Lightspeed Payments: Fast, reliable payments straight from your POS

Lightspeed’s unified POS and Payments solution provides a seamless and fully supported payments system that’s committed to your growth and success. As Lightspeed continues to innovate, businesses can take advantage of the perks offered by an embedded payment system.

- Stop chasing the banks and enjoy access to expert support 24/7

- Enjoy low rates and no terminal rental fees

- Use the latest payment terminals, free for all your locations

- Built-in PCI compliance and fraud prevention for peace of mind

- Split bills, add tips, process refunds and add surcharges

It doesn’t stop there. With Lightspeed Payments, transaction fees are reinvested back into further developing other tools used in Lightspeed.

“The key advantage of our platform is that by focusing on unified payments, our innovation and research spending can go into faster release of new product innovations,” says Andrew Fraser, Managing Director for Lightspeed APAC.

“We can double down on investment in the platform, adding features, analytics and insights so that we can save [businesses] time and give them more peace of mind. That means an even better experience for these owners going forward.”

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.